Biden Student Loan Forgiveness: Navigating Financial Freedom

In today’s economic landscape, student loan debt is a pressing concern for millions of Americans. The prospect of Biden student loan forgiveness has sparked hope and curiosity among borrowers nationwide. This article delves deep into the subject, providing you with the essential information you need to understand this transformative policy.

Biden Student Loan Forgiveness Explained

Understanding the Basics

The Biden Student Loan Forgiveness program is a government initiative aimed at providing financial relief to students burdened by hefty education loans. It promises to be a game-changer for those grappling with the weight of student debt.

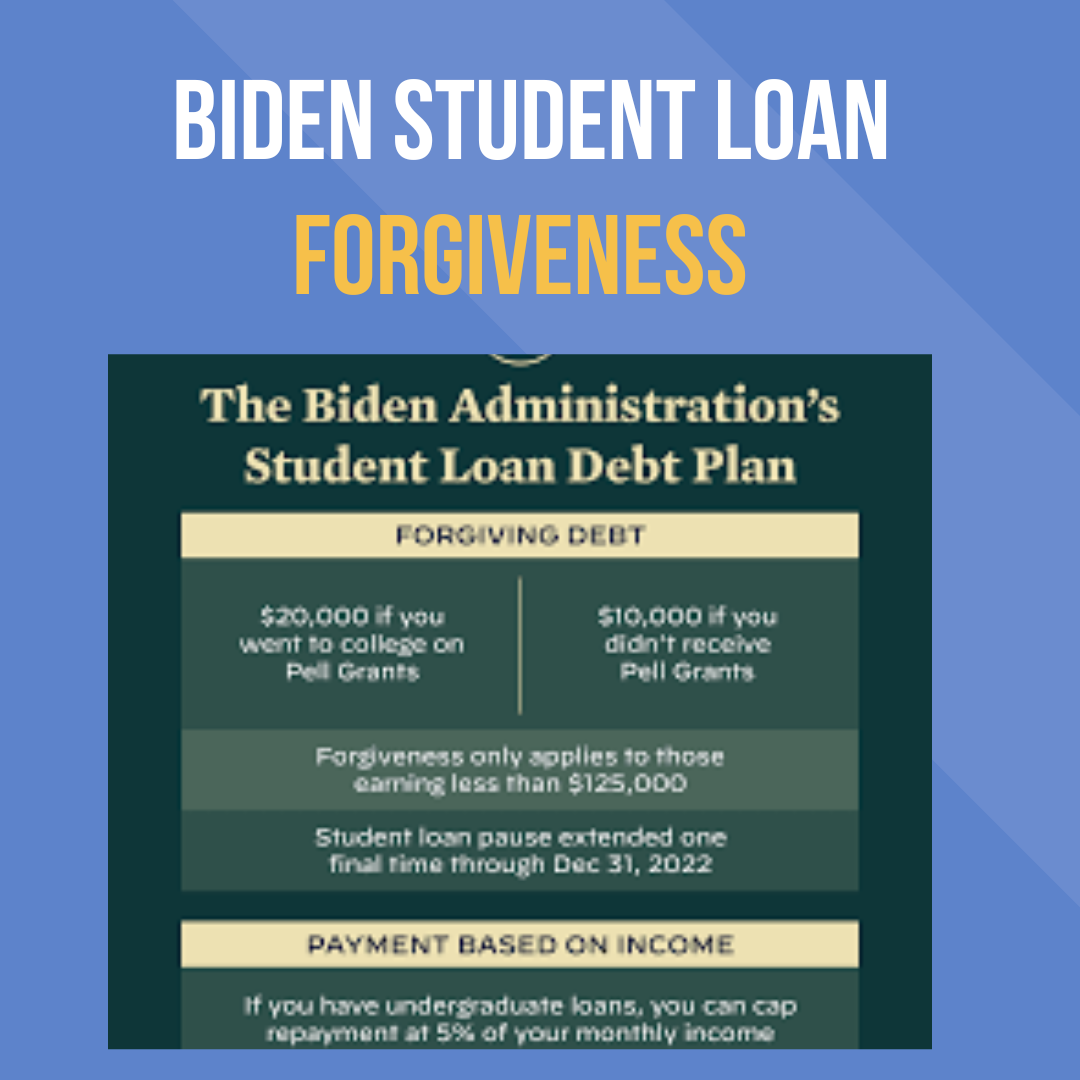

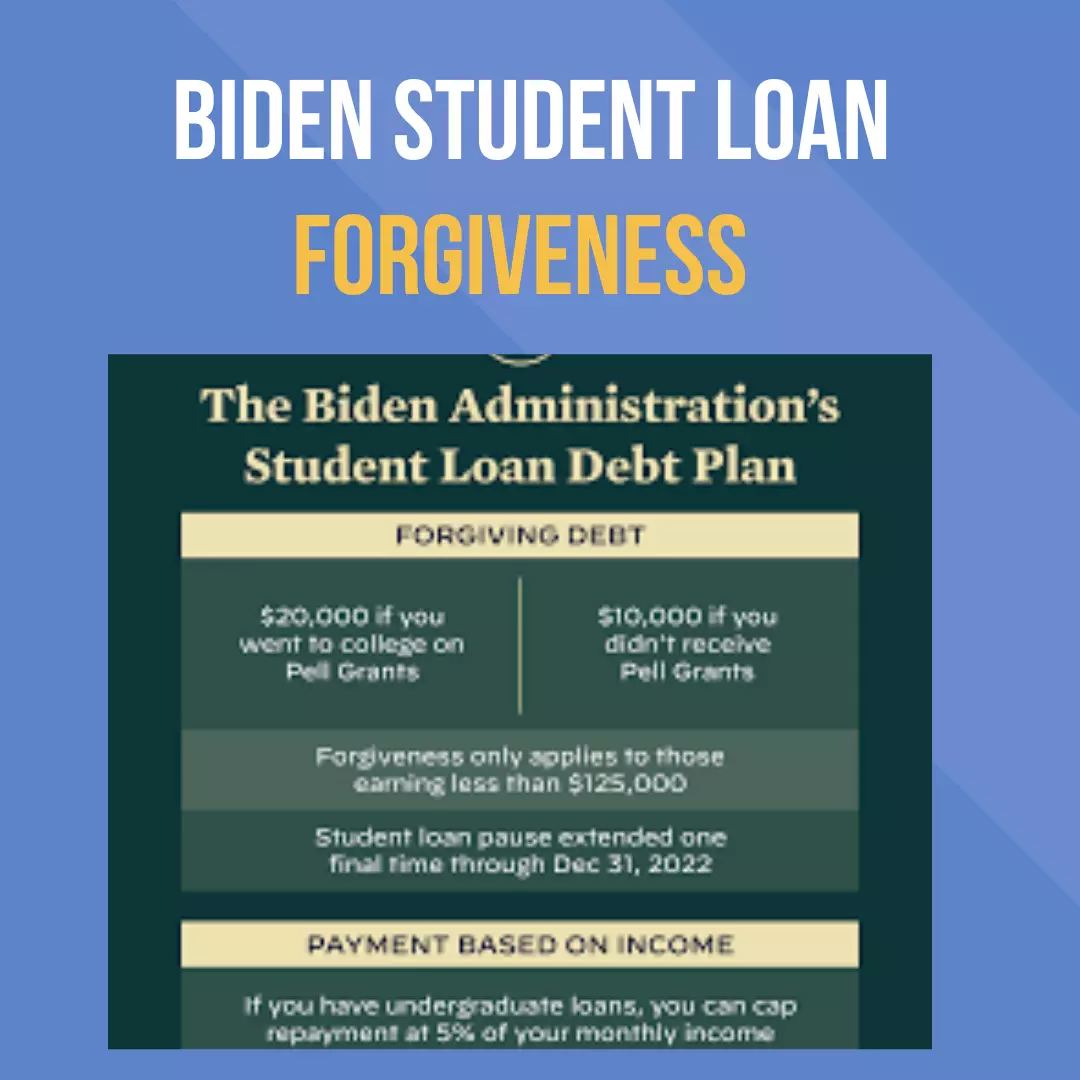

Eligibility Criteria

Before you can reap the benefits of this program, it’s crucial to meet certain eligibility criteria. These include income thresholds, types of loans, and more. Understanding these prerequisites is the first step toward securing loan forgiveness.

The Different Forgiveness Plans

Biden’s plan offers multiple forgiveness options, such as income-driven repayment plans and public service loan forgiveness. Each plan is tailored to specific circumstances, ensuring a personalized approach to debt relief.

How Biden’s Student Loan Forgiveness Impacts You

Financial Freedom

Imagine a life without the constant worry of student loan payments. Biden’s forgiveness program aims to free you from this financial burden, allowing you to allocate your resources toward achieving your dreams.

Credit Score Improvement

Student loans can have a significant impact on your credit score. Discover how enrolling in the forgiveness program can positively affect your financial reputation.

Career Choices

With student debt no longer looming over your head, you may find the freedom to pursue the career you’re truly passionate about. Learn how this policy change can open doors to new opportunities.

Best Content For You

- Top 10 Best Mesothelioma Law Firms In the U.S

- The Benefits of Working with an Experienced Asbestos Lawyer

- Top 10 Best Insurance Companies In The US: Expert Picks

- The Most Reliable Life Insurance Companies of 2023

- The Auto Advocates: The Best Texas Lawyers For Accident Cases

FAQs

How do I apply for Biden student loan forgiveness?

The application process is straightforward. You can apply through the Department of Education’s website, providing your income information and loan details. It’s essential to stay informed about the application deadlines.

What types of loans are eligible for forgiveness?

Most federal student loans, including Direct Loans and Federal Perkins Loans, are eligible for forgiveness. However, private loans are not covered under this program.

Will my forgiven loans be taxed?

As of now, forgiven student loans are not taxed. However, it’s crucial to keep an eye on tax regulations, as they may change in the future.

Can I switch forgiveness plans?

Yes, you can switch forgiveness plans if your circumstances change. It’s advisable to consult a financial advisor to determine the best plan for your current situation.

How long does it take to get loan forgiveness?

The timeframe for loan forgiveness varies depending on the chosen plan and your specific circumstances. Some borrowers may qualify for immediate forgiveness, while others may take several years.

Can I still qualify if I’ve missed payments?

While it’s possible to qualify for loan forgiveness if you’ve missed payments, it’s essential to get back on track with your payments to maximize your chances.

Conclusion

Biden student loan forgiveness holds the promise of financial liberation for countless Americans. By understanding the intricacies of this program, you can make informed decisions about your future. Embrace the potential for a debt-free future and take control of your financial destiny.